Walmart’s Marketplace Model and the Power of the Long Tail

Why RMNs Must Diversify their Advertiser Base to Reach their Revenue Potential

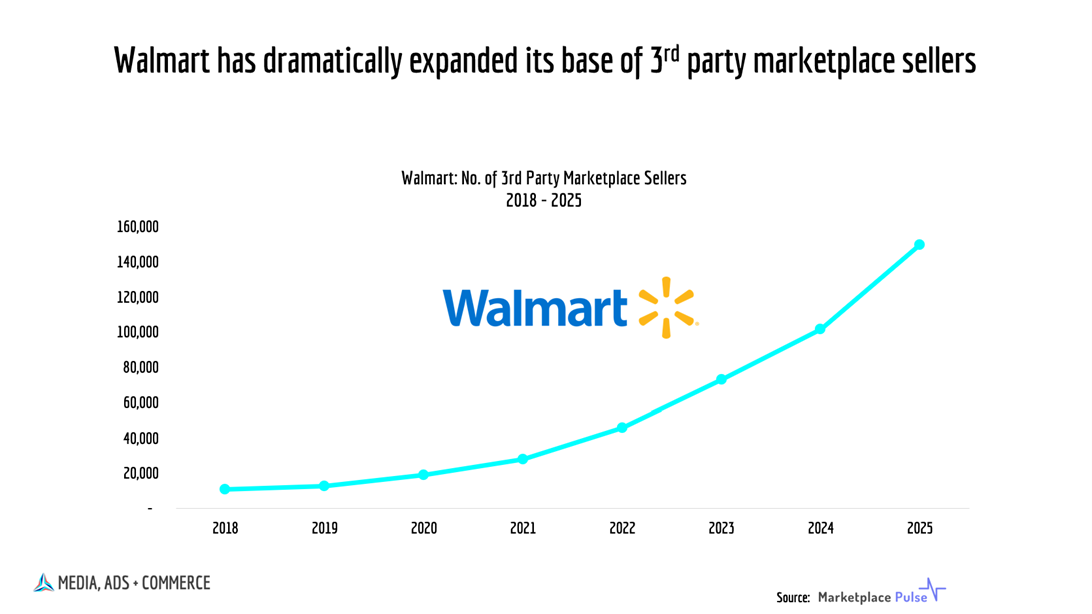

Walmart just posted another outstanding quarterly earnings, with operating profits outpacing sales growth due to the ongoing strength of their ecommerce marketplace (+42% Y/Y) and advertising (+28% Y/Y) businesses. Walmart’s expansion of its third-party (3P) marketplace is a deliberate strategy—set in motion in the aftermath of the Jet.com acquisition in 2016—that hit an inflection point in 2022 and is now clearly in acceleration mode.

Here’s how Doug McMillon, Walmart President & CEO, explained its rationale on the company’s Q4 2022 earnings call:

“Growing our marketplace expands choice for our customers, helps our sellers grow, and enhances our profit margins. As we bring more customers, sellers, and suppliers into our ecosystem, it expands our ability to monetize those relationships… And as our e-commerce business, including marketplace, continues to grow, so will our advertising business.”

According to Marketplace Pulse, Walmart grew its number of 3P sellers from ~10,000 in 2018 to ~50,000 around the time of these remarks in early 2022. Walmart has since tripled that number to 150,000.

Pentaleap and Colosseum Strategy recently joined forces on the H2 2024 Sponsored Products Benchmark report, which features the latest insights on RMN ad placements and monetization, plus brand-new analysis of RMN marketplaces. A full copy of the report can be downloaded here.

Walmart’s marketplace expansion follows the 2020 launch of Walmart+, the company’s answer to Amazon Prime. It also coincides with other major changes to Walmart Connect under the leadership of CRO Seth Dallaire, who joined the company in October 2021. In mid-2022, Walmart overhauled its ads business with a couple of key changes to better align with its marketplace strategy, creating the conditions for its meteoric rise over the past two years.