“Transactions are the New Cookies”: Part 2

Why 1P Retailer Data is the Future of Display Ad Targeting—and Verification

“We must not trade our advertising inventory like pork bellies.”

This famous admonition in 2008 by Wenda Harris Millard, at the time the incoming chair of the IAB and former Yahoo revenue chief, went unheeded by the digital advertising industry. To its ultimate detriment.

“The notion that simply aggregating masses of inventory without consideration and appreciation for the content and the context ... is basically just creating volume, which leads to lowering prices,” she would go on to explain in an AdAge article later that year. “Where in that equation is the discussion about value? Where in that equation is brand stewardship?”

In a commoditized environment, ad monetization is predominantly dictated by the forces of supply and demand. The rise of programmatic advertising has led to an egregious—and mostly fake—increase in supply that has eroded publishers’ ability to generate sustainable ad revenue.

Fast forward to today, and digital publishers are on life support. Not only are they forced to scrap and claw for bottomed-out CPMs, they face adverse selection by programmatic platforms because human audiences drive lower viewability rates and fewer clicks.

But there’s a way out of this quagmire. Retail transaction data will lead the way.

In part 1 of this article, we analyzed the reason that retailers’ first-party data will power the future of display ad targeting. In part 2, we posit a future in which retailer data serves as the primary verification layer for the open web.

I’ll summarize the detailed argument that follows:

Invalid traffic (IVT) is the primary cause of wasted advertiser spend, is woefully underestimated, and requires new approaches to solve the issue.

The rise of gen AI will make IVT exponentially worse because it’s trivial for fraudsters to create more fake inventory that siphons ad dollars from legitimate publishers.

It’s not enough to blacklist made-for-advertising (MFA) sites because new ones can be created faster than existing ones can be blocked. The industry needs a way to prove which sites have real audiences so they can be whitelisted.

Because existing campaign KPIs like viewability, clicks, conversions, and ROAS are being manipulated by IVT, new measurement approaches are needed to determine which inventory actually performs.

Applying incrementality measurement to retail transaction data can provide the data signal needed to identify which sites have real audiences and deliver real impact to advertisers.

It’s time for ad verification reform—rooted in retail transaction data—to restore proper functioning to digital ad markets.

Identifying Digital Ad Waste’s Main Culprit: IVT

I’m not sure why, but the digital advertising community gets easily distracted from the biggest issue in front of it: IVT.

Much of the conversation today centers on brand safety. Advertisers harbor legitimate concerns, of course, about their brands appearing alongside objectionable user-generated content on social platforms and seedy websites that slip through the cracks of verification. Publishers are outraged over overactive brand safety filters that divert impressions away from their legitimate inventory.

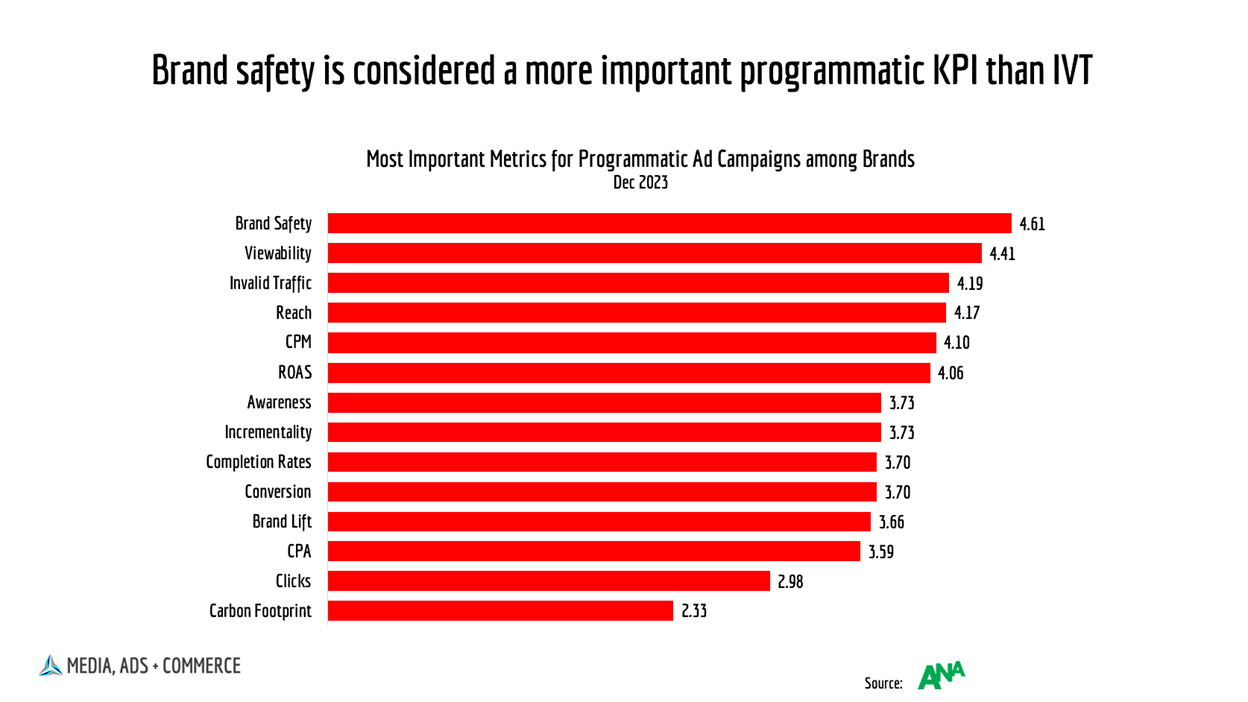

According to the ANA’s 2023 Programmatic Media Supply Chain Transparency study, brand safety ranked as the most important metric for advertisers in programmatic ad campaigns. IVT ranked third.

Not to minimize the importance of brand safety, but it pales in comparison to IVT in distorting industry economics. Lost opportunity due to misapplication of brand safety verification is a constrained problem—a subset of valid impressions. IVT, on the other hand, is unconstrained because in the era of gen AI the ability to create a virtually endless supply of new fake websites has become trivial.

IVT fundamentally undermines the proper functioning of the digital advertising marketplace. It distorts campaign KPIs like viewable impressions, clicks, conversion, and ROAS, directing more dollars to the least productive inventory. And it disrupts the market forces of supply and demand.