“Transactions are the New Cookies”: Part 1

Why 1P Retailer Data is the Future of Display Ad Targeting—and Verification

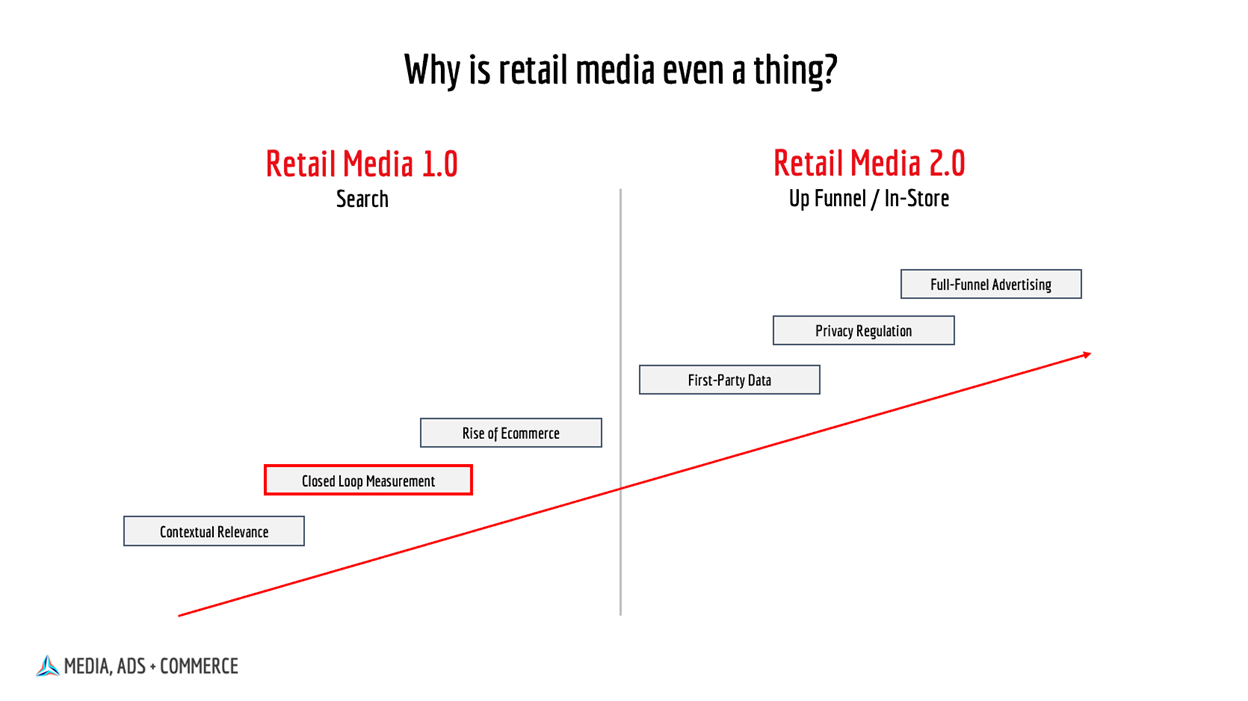

Why is retail media even a thing?

It’s a question I’m regularly asked by advertising industry folks.

I’ve always considered the most obvious explanation to be contextual relevance. Ads appearing in a shopping context—often close to the point of sale—should be more valuable than ads appearing elsewhere.

After my initial shock in 2018 at learning that Amazon had become the No. 3 US ad seller, I realized this growing ad juggernaut made perfect sense. Ecommerce search ads were “Google ads on steroids”—effectively the same money-printing machine but even closer to the point of purchase.

This was retail media 1.0: the search era.

A key driver of Google’s early digital advertising dominance was closed-loop measurement. Advertisers could put $1 of investment in and get $1.50 out, making search very easy to invest against. With early retail media featuring that same closed-loop system, brands found it similarly easy to invest.

Then came COVID, and as shopping and buying shifted to the ecommerce channel—particularly in categories like grocery/CPG—ad dollars followed. Retail media surged 54% that year, and another 53% in 2021, per EMARKETER.

But as the deluge of new retail media investment eventually tapered circa 2022-23, the conversation began to change. To keep budgets flowing, retail media would need to move up the funnel and into the store—the dawn of the 2.0 era.

Retailer Data as a Solution to the Cookieless Future

During the 2.0 era, retail media latecomers saw this trend primarily as a response to growing privacy regulation and the need for first-party data. As a result, the trend’s very existence was often conflated with the deprecation of third-party cookies.

At most, it would be a mild accelerant.

The dominant factors behind retail media’s rise were always closed-loop attribution (dollars follow measurement) and better data (shopper data is a stronger targeting signal than behavioral data).