The Third Wave’s Incrementality Tide is Coming In

And We’re About to Find Out Who’s Been Swimming Naked

I recently led a roundtable discussion at the RMN Ascendant Boot Camp—along with Claire Wyatt, VP of Business Strategy & Marketing Science at Albertsons Media Collective and Jaiah Kamara, Director of Reporting & Insights at Best Buy Ads—on the relative merits of ROAS and iROAS.

Here’s how Claire described the scene in a LinkedIn post:

At the Ascendant Network #retailmedia event this week in Palo Alto Andrew Lipsman and Jaiah Kamara and I led a conversation on ROAS vs. iROAS. We polled the room and asked, “how do you feel about ROAS – 5 means you love it, 1 is you hate it and hope to never see it again.”

The room was less divided than I thought. In a group of Brands, Retail Media Networks, and Tech partners, no one had higher than a 3, with most of the group at a 2.

💡 Turns out, we’re all in alignment that ROAS isn’t a great metric! 💡

We all know that it’s overly correlated to brand sales. We all know it’s easy to manipulate. We all are aware that if we try to present a ROAS that is more conservative and more transparent, we can lose out to our competitors who have a ROAS calculation which is more of a black box.

That the overwhelming majority of incrementality acolytes gave a score of 2 rather than a 1 was telling, capturing the consensus view of ROAS as highly flawed while conceding the difficulty of discarding it entirely.

Claire’s final point is also critical. In the absence of transparent and consistent reporting, RMNs are incentivized to engage in metrics gamesmanship just to compete with each other—not to mention other channels—for ad dollars.

Even when they know better.

If Everyone Knows Better, Why is ROAS Still a Thing?

The resilience of ROAS stems from its ubiquitous use in retail media and across digital media more broadly. Ad investments—not to mention people’s bonuses—are often predicated on this metric. And inertia is a powerful force.

“History has shown us that media dollars tend to follow ‘easy,’” said Skye Frontier, SVP of Growth at Incremental. “That ease has lured the industry into adopting a metric which is disconnected from the financial metrics of the business. ROAS mistakes coincidence for causality, so it is entirely possible to optimize towards ROAS and actually see no impact on topline revenue growth.”

RMNs end up being both beneficiaries and victims of ROAS. They benefit from brands who don’t understand that many attributed sales would have happened anyway, and therefore aren’t incremental. An unsophisticated advertiser generating a $5 ROAS from a retail media campaign is likely to keep investing its ad dollars.

But RMNs are also disadvantaged by ROAS, since their reported metrics often compare less favorably to paid search and social, as a November 2022 Bain study found. When brands optimize across channels, they’re likely to keep their investment in two channels very adept at claiming credit for an attributed sale. Nobody ever gets fired for buying Facebook and Google ads.

Retail Media Networks Win on iROAS

If RMNs want to command more budget from brands, they’ll need flex their incrementality muscle. Because that’s where their strength lies.

In my keynote at RMN Ascendant the following day, I used several examples to illustrate retail media’s many sources of untapped value in arguing that it remains underinvested as a media channel.

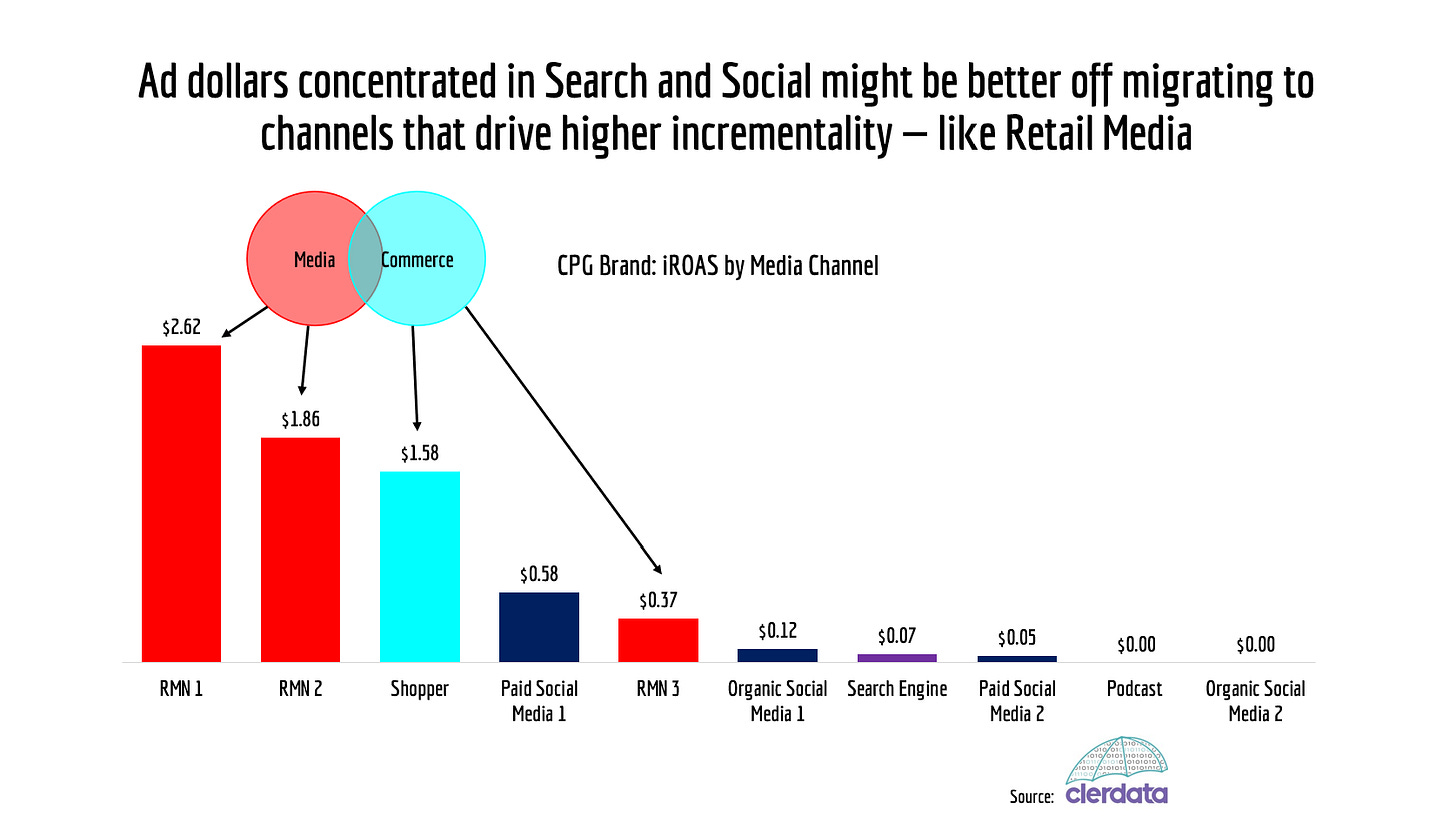

At one point, I unveiled the most consequential slide of the presentation: the results of an incrementality study conducted on behalf of a large CPG brand by Clerdata.

Of the ten channels included in the study, RMNs ranked as the top 2 overall and 3 out of the top 5. A digital shopper marketing tool—similar in ways to an RMN—ranked third. Meanwhile, the paid social and search channels generally struggled to deliver positive incrementality.

The results of this study are extraordinary precisely because they are typical. Across this and numerous other cross-channel incrementality studies, Clerdata consistently finds that RMNs lead the pack in iROAS.

“To drive incremental brick-and-mortar retail sales, retail media investments with certain networks seem to have some of the highest incremental returns,” said Meghan Corroon, co-founder and CEO of Clerdata.

Of course, results may vary by product category, size of brand, media strategy, creative quality, or other factors. But this study points in the direction of retail media’s ability to produce incrementality.

Speaking to a room filled with dozens of leading RMNs, my message was clear: RMNs are being undervalued—and therefore underinvested—as a media channel. At the same time, I cautioned in pointing to RMN 3: Not every RMN’s incrementality is guaranteed.

Maximizing iROAS Within the Retail Media Channel

As I’ve written previously, retail media’s unique power to deliver incremental sales is derived from the synergistic effects of media and merchandising.

Unless both dimensions are satisfied, retail media loses its ability to outperform on incrementality. Failure on the media dimension comes from non-performing inventory, such as non-viewable ads or bot traffic. Failure on the merchandising dimension comes from lack of customer appeal, due to factors like weak creative or poor search ad relevance.

RMN ad formats that most effectively combine media and merchandising will tend to deliver the highest iROAS. Here’s how to think about maximizing incrementality within on-site, off-site, and in-store retail media.

On-Site Retail Media – With the highest concentration of ad dollars, on-site is where incrementality exhibits wide variance. Because brands can just as easily squander their dollars as generate outsized returns, it’s critical to deploy the right ad formats and targeting tactics.

According to a December 2023 study by Incremental, Sponsored Brands (aka “the digital endcap”) outperformed Sponsored Products on iROAS, despite having lower ROAS on average. Sponsored Brands Video and its theoretically higher-impact creative performed the best.

The targeting tactics are where incrementality gets interesting. On one extreme, investing in Sponsored Product branded search ads produce minimal iROAS despite high ROAS. On the other extreme, Sponsored Brands Conquesting ads produce huge iROAS but weak ROAS.

Off-Site Retail Media – This channel has the most question marks due to a relative lack of incrementality research. Today, many brands perceive off-site retail media to be a bad investment because of lower-than-average ROAS—which is primarily a byproduct of the “RMN data premium” paid on top of existing media costs. All else equal, higher costs make ROAS look worse by default.

This effect is most pronounced in retail media-powered CTV (as this 2023 McKinsey study indicates), which often carries CPMs several multiples higher than other digital ad formats. But it could be a very different picture when incrementality is accounted for. “Among Amazon tactics, CTV ads are showing a lot of promise,” Corroon said.

Off-site retail media’s potential for incrementality depends substantially on ensuring media quality, which is not a trivial matter in this channel. Rampant ad fraud and viewability issues—in both programmatic open web and CTV—threaten to render these ads irrelevant. When ad impressions fail to reach actual human audiences, by definition they will zero out on iROAS.

RMNs that don’t proactively qualify the inventory they’re plugged into risk problems down the road.

In-Store Retail Media – I’ve reported on meta-studies from in-store retail media networks proving the medium can deliver incremental sales. Ads that appear in the context of the shopping experience, and in the channel where most retail sales happen, should be high leverage.

The specific combination of dynamic digital media and physical world merchandising is a marvel of marketing effectiveness—perhaps unparalleled by any other medium.

And given in-store retail media’s currently embryonic state, now may be the best time to take advantage of an advertising arbitrage before other brands catch on. All of this points to high iROAS potential.

What Does it Say if Even Amazon Ads is Still Underinvested?

Amazon is the most widely used, competitive, and mature RMN. According to recent data from Pentaleap, Amazon had sponsored product ad coverage of 99% of its searches, and an average of 11 sponsored product impressions per search results page.

When advertising channels become saturated, iROAS should evaporate. Yet even the dominant RMN appears to have plenty of running room. “We still see quite a lot of opportunity with Amazon investments, especially to drive incremental halo sales [at] brick-and-mortar retail,” said Corroon.

Because brick-and-mortar retail represents 85-90% of most CPG brands’ sales, it’s where a lot of incremental brand sales occur. But it’s often not accounted for with existing ROAS calculations. In addition to driving ~40% of ecommerce sales, Amazon is also a primary research channel for products purchased in physical stores and it follows that its mid- and upper-funnel formats would also influence offline conversions.

Recent “halo effect” research by Clerdata found that different Amazon ad formats—search, display, online video, and CTV—drove positive iROAS for both Amazon.com and total retailer sales for a CPG brand. Interestingly, Amazon CTV ranked No. 3 among 8 media tactics analyzed in driving incremental total retailer sales, but only No. 7 in driving incremental Amazon.com sales. Most of its incremental impact is happening offline and in other retailers.

Of course, advertising on Amazon isn’t a slam dunk, either. “We do see quite a bit of overinvestment in certain types of ads that are not performing and then underinvestment in other Amazon ad types,” added Corroon. “Very rarely do we encounter a customer that has optimized their existing investments.”

That Amazon maintains such incrementality upside is a huge tailwind for competing RMNs. They should have much more relative upside to tap, beginning with improving on-site ad coverage and ad load, and extending to off-site and in-store ad formats. Little of this will become evident to them—and more importantly to brands—without broader adoption of iROAS.

When the Incrementality Tide Rolls Out, Who Will Be Swimming Naked?

RMNs should embrace iROAS now because they have the most to gain. And because certain brands—which I’d argue represent the smart money in digital advertising right now—are demanding better measurement. Most are CPG brands facing a “perfect storm” of too many marketing channels to manage and a price-sensitive consumer.

“These factors have led to a much overdue push for better evidence to drive investment,” added Corroon. “Incrementality is the answer to that problem.”

We’re still in the early days of incrementality measurement, and there’s more research to be done. On the other side of this research is a better understanding of which advertising works and which does not.

The dirty secret of digital advertising is that most dollars are wasted.

If you want to know where the waste is, start by looking at the large pools of ad spending being algorithmically allocated according to proxy metrics like ROAS and click-through rates.

Programmatic open web, branded search, and paid social are all good candidates. (That Meta captures 3x as much digital ad revenue as time spent is one signal of a possibly over-invested channel.)

But we won’t know for sure unless incrementality measurement isn’t just accepted but prioritized by brands. After all, it’s their dollars being spent.

When that happens, ad sellers will have to adapt their media to maximize actual advertising effectiveness. No more gaming the system with sub-prime inventory and proxy metrics. With an iROAS standard, there’ll be nowhere to hide.

The incrementality tide is coming in, so ad sellers better watch out. We’re about to find out who’s been swimming naked.