The RMN Scalability Index

30+ RMNs Can Achieve Revenue Scale by Embracing their Inner Media Company

“We are becoming both a retailer and a media company.”

This declaration by Best Buy CEO Corie Barry at the company’s recent advertising upfront is precisely the ambition needed to scale the retail media network into a multi-billion dollar revenue stream.

The 30-minute pitch to advertisers that followed revealed a retailer that’s already backing up its words with action.

Best Buy Ads not only offered a vision signaling confidence about the future, the consumer electronics retailer provided a model for emerging RMNs to follow:

C-Level Sponsorship – Barry’s involvement in the event and vocal embrace of the advertising business is a major flex. Chief Customer, Product & Fulfillment Officer Jason Bonfig’s inclusion demonstrated organizational alignment between merchandising and media. C-level buy-in that retail media is a priority, not a side project, is a critical foundation to power the business forward.

Acting Like a Media Company – Best Buy captured the ethos of a true cross-platform media company plugged into the current zeitgeist. They spoke the language of big water media, with terms like reach, engagement, share of voice, and cultural relevance.

Third-Party Marketplace – Best Buy spotlighted its newly-launched 3P marketplace on multiple occasions, boasting 100 new sellers and a doubling of its product assortment. It’s no accident that Best Buy put its biggest emphasis on its likely biggest growth driver over the next years.

Physical Store as a Media Channel – Best Buy unveiled its new “store takeover” package, an amped up version of its existing in-store media network that includes new store exterior and front-of-store displays. This is tailor-made to capture national media budgets for both endemic and non-endemic brand advertisers.

Appeal to Non-Endemic Advertisers – Multiple Best Buy offerings seemed designed to attract non-endemic advertisers in categories like QSR, Media & Entertainment, Telecom, and Automotive. The company also unveiled partnerships with leading DSPs Google DV360, Yahoo DSP, and The Trade Desk that will expand access to Best Buy’s first-party data for off-site activation.

Media Partnership – In addition to the DSP triumvirate, Best Buy name-checked partnerships with the NFL, TGL (TMRW Golf League), Google, Meta, Roku, and CNET—direct links to some of the premier media and entertainment brands today.

Collectively this represents a sound strategy for growth and the confidence to execute on it. And it reveals a company that’s not just looking for its fair share of the retail media market–it’s looking to compete with giants of media for ad dollars.

“There’s so much retail media can do and if done right, it can deliver in so many ways just like one of the ‘big media companies’ you’d think of today,” said Lisa Valentino, President of Best Buy Ads. “Our goal is to be in that same consideration set for people looking to buy media. Right alongside those major media companies because we can deliver something truly distinct that delivers.”

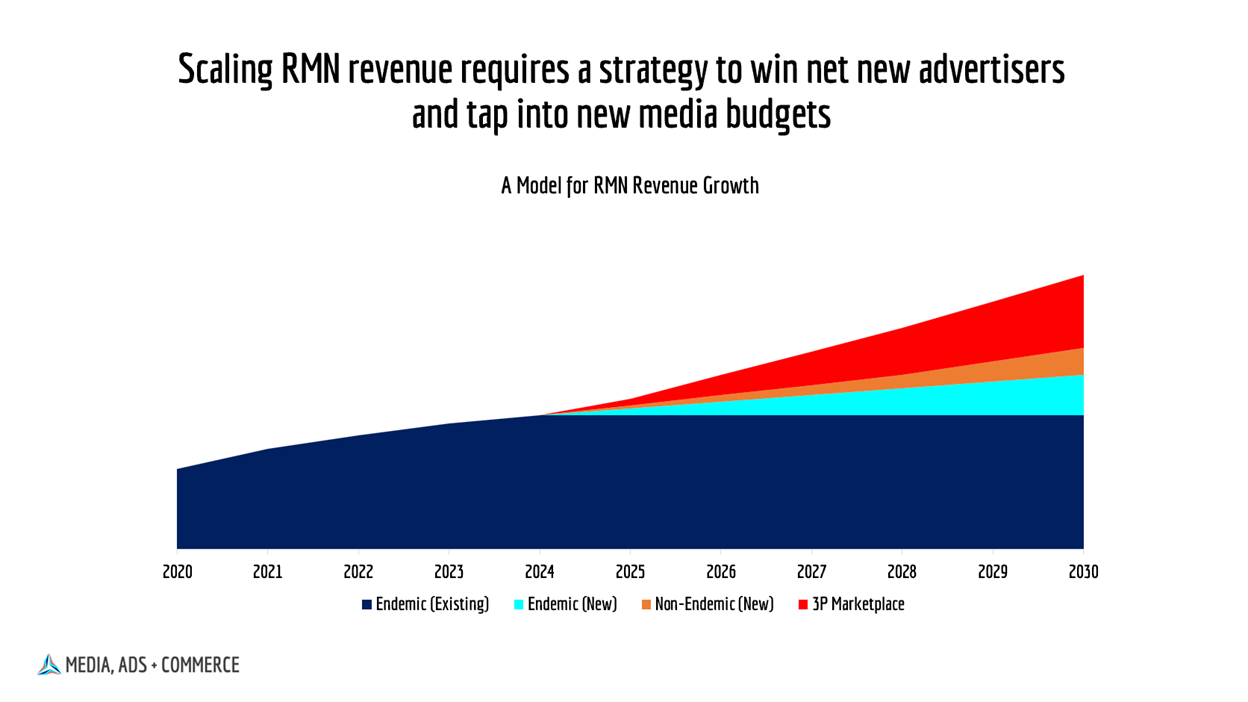

A conceptual model for Best Buy’s revenue growth strategy might look like the following: