The Retail Media Flywheel: Media, Ads + Commerce

How Next-Gen RMNs Can Scale High-Margin Ad Businesses

Amazon’s New Flywheel

"We get to monetize in a very unusual way," Amazon founder Jeff Bezos said in a 2016 interview at the Code Conference. "When we win a Golden Globe, it helps us sell more shoes.”

Bezos was referencing the company’s fledgling bet on original content on Prime Video, articulating the premise behind the retail media flywheel well before anyone even realized Amazon would soon build an advertising juggernaut.

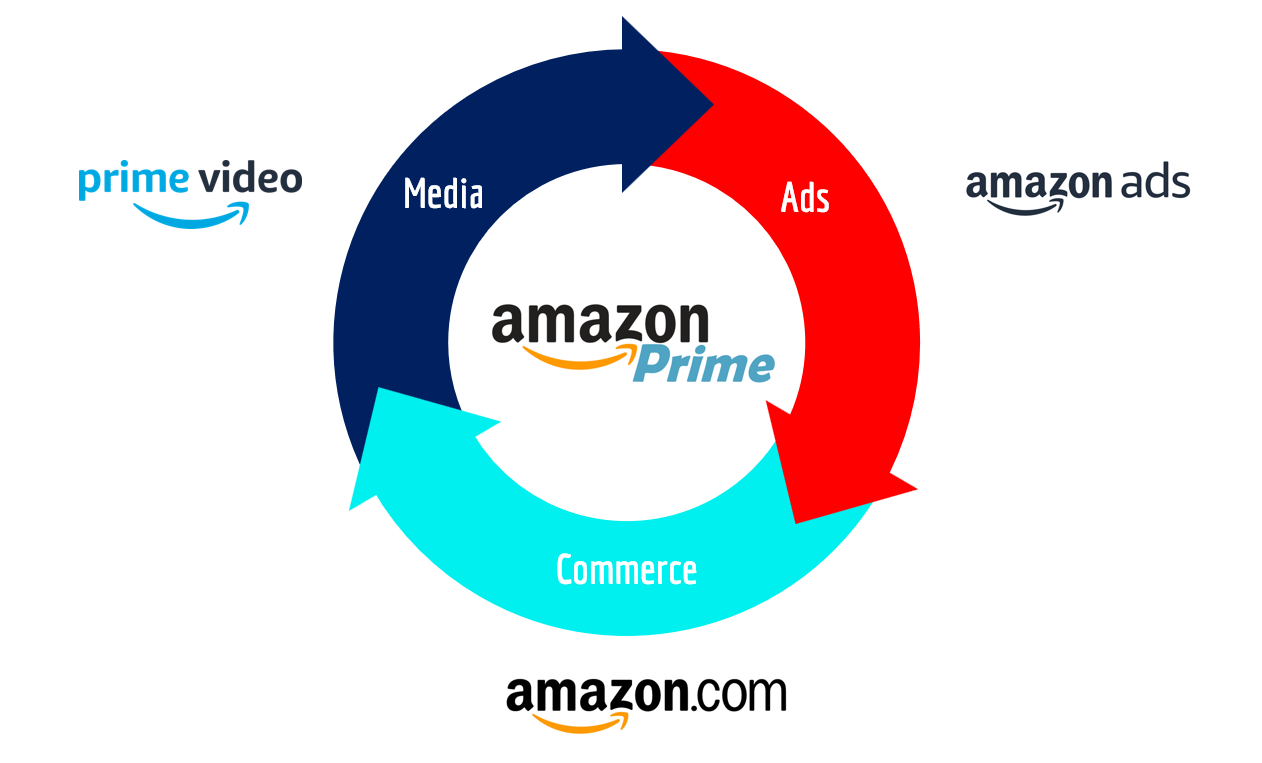

Fast forward to September 2023, when Amazon introduced ads to Prime Video. The decision may have been seven years in the making but was in many ways inevitable. It connected the most valuable components of Amazon’s new flywheel: media, ads, and commerce.

Amazon’s original flywheel—predicated on the dimensions of selection, price, and convenience—fueled the company’s eventual dominance of commerce. But the “Everything Store” didn’t begin that way: Amazon originally sold books and won customers with access to the long tail, eliminating constraints on selection with digital’s endless aisle. It expanded this approach into new product categories, and launched its third-party marketplace to increase selection, and in doing so created the dynamics for price competition. In its most recent phase, Amazon has invested significantly in logistics to drive down shipping times and deliver convenience for customers.

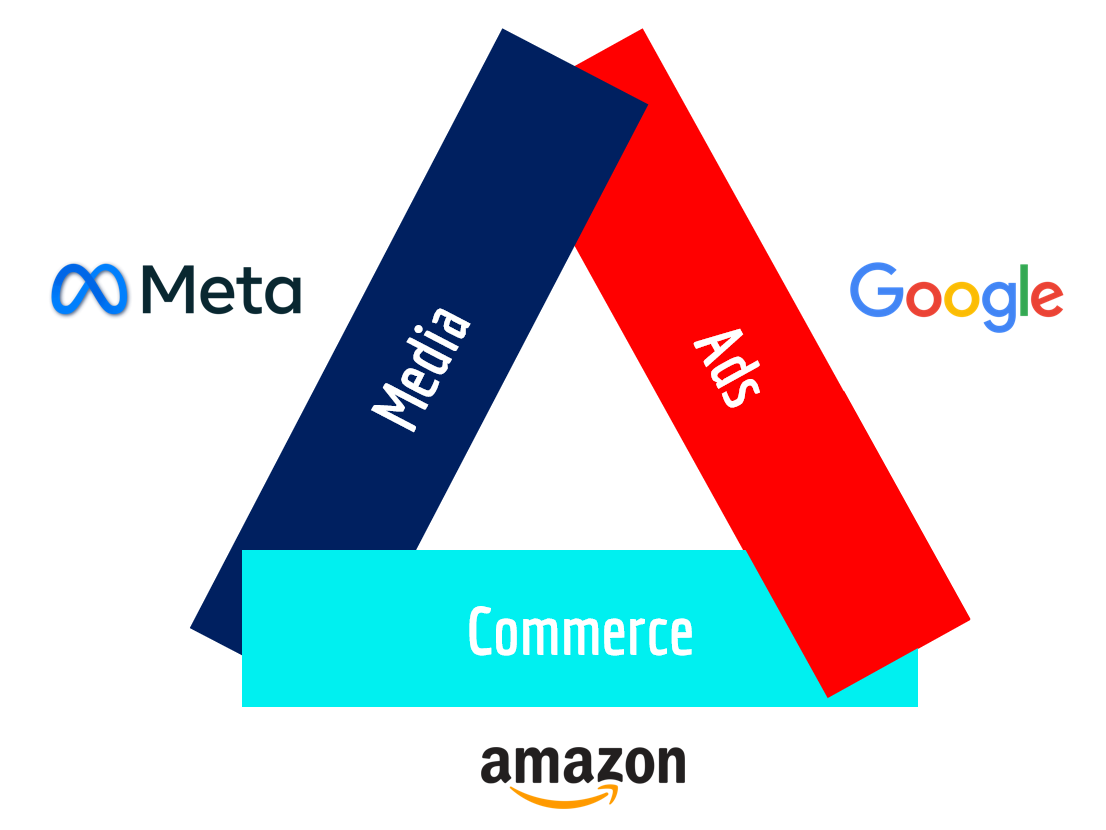

By 2016 the company’s position in commerce had been well-established, but it trailed its primary competitors—Google and Meta—in the other two coins of the digital realm. The duopoly maintained a collective stranglehold on the media and advertising pillars, with commerce clearly in their crosshairs.

Meanwhile, Amazon quietly invested in media, placing big bets on Alexa and Prime Video as critical pieces of its future flywheel. At the same time, a formidable ads business began to take shape—primarily in the form of ecommerce search ads—though it flew below the radar for years.

If anyone were to handicap the odds of Amazon, Google, or Meta completing the trifecta of media, ads, and commerce in 2016, Amazon would’ve clearly been the long shot. Yet it has managed to pull off the improbable. As Google and Meta tried and failed several times over to crack the code on commerce, Amazon made huge strides in media and advertising. It is now the canonical example of the retail media flywheel.

Prime Membership is the Fulcrum of Amazon’s New Flywheel

At the center of Amazon’s new flywheel is Prime membership. “If you look at Prime members, they buy more on Amazon than non-Prime members, and one of the reasons they do that is once they pay their annual fee, they're looking around to see, 'How can I get more value out of the program?',” Bezos elaborated during the 2016 Code Conference interview. “And so, they look across more categories — they shop more. A lot of their behaviors change in ways that are very attractive to us as a business. And the customers utilize more of our services.”

If Prime membership is the fulcrum on which Amazon’s new flywheel spins, then Prime Day is like an extra spin of the flywheel to help it gather momentum. Amazon’s annual promotions drive new Prime subscriptions, encourage buying across more categories, coax more spending and higher engagement from advertisers, and subsidize adoption of media assets like Prime Video and Alexa-enabled devices.

Like a hurricane gathering momentum, Amazon’s new flywheel is now expanding. Amazon Fresh is of course an attempt to take a slice of the $1 trillion US grocery market and bolster its commerce leadership. But it’s really about adding to its massive first-party data trove and capturing in-store shopping and buying behavior for CPG brands to fuel its closed-loop targeting and attribution capabilities.

Amazon’s primary constraint on this powerful closed-loop apparatus is media inventory. Its owned media assets, including Prime Video, Freevee, and Twitch, provide the foundation for disruption of the TV advertising market as we know it.

Acquiring the rights to high-rated TV programming like NFL Thursday Night Football has put the TV industry on notice. Amazon can also make its content more discoverable when it owns the TV OS, which it uses Fire TV devices to accomplish. When Amazon owns the TV OS, it can incorporate more shoppable content with seamless integration to Amazon.com, funneling that value right back into the commerce pillar.

Undoubtedly shoppable TV is part of Amazon’s future vision, with Amazon’s inaugural Black Friday NFL game giving the clearest glimpse into that future. But if the early returns are any indication—Amazon.com lost ecommerce market share to Walmart.com on Black Friday 2023, per data from Rithum—getting viewers to shop via QR codes will take some time.

Shoppable media today primarily exists on social platforms, which explains Amazon’s recent moves to partner with Pinterest in April 2023 and Meta and Snap in November 2023. The more inventory into which Amazon can plug its closed-loop apparatus, the more powerful it becomes.

How RMNs Can Model Amazon’s Playbook

Amazon’s playbook is nothing short of remarkable. It explains why Amazon has 75% of the US retail media market today and is such a worthy adversary to the hundreds of emerging RMNs.

But competing retailers now have a playbook to model, even if few will ever boast Amazon’s considerable assets and latitude to invest. Fortunately for next-gen RMNs, carving out even a single percentage point of market share over the next three years represents a $1 billion high-margin revenue stream.

Here is how these RMNs can adapt Amazon’s playbook to build flywheels of their own.

1. Develop and fortify a top-tier loyalty program

2. Drive as much commerce through the loyalty program as possible

3. Model Amazon’s ad business, leveraging marketplace dynamics to create competition among brands

4. Partner with—or even acquire—top-tier providers of premium inventory across digital publishing, streaming TV, and programmatic channels

5. Reinvest a portion of ad business profits to keep expanding the flywheel radius

Walmart is Executing the Media, Ads + Commerce Flywheel to Perfection

Walmart is now a strong No. 2 in the US retail media market despite taking a while to find its footing. But the Walmart Connect business has recently accelerated under the direction of Chief Revenue Officer Seth Dallaire, a key architect of Amazon Ads and Instacart Ads.

The foundation of Walmart’s new flywheel began to take shape with the mid-pandemic launch of Walmart+. The omnichannel retail giant’s answer to Amazon Prime helped it gain share of wallet while converting more transactions into first-party customer data.

Walmart’s new flywheel began to flourish following its 2021 tie-up with The Trade Desk as brands could buy programmatic display, video, and CTV ads using Walmart’s first-party data.

A more visible inflection point came the following year when Walmart Connect improved its core ad offering, instituting a second-price auction and refining its search algorithm to level the playing field for marketplace sellers. Almost instantly, cost-per-click went down, ROAS went up, brands felt more confident in the platform, and the ads business took off.

This has helped drive more commerce—Walmart.com has consistently outpaced the competition in ecommerce in recent years—and made Walmart a more attractive partner for media companies. It has recently added NBC Universal, Roku, and TikTok to its growing stable of premium content partners, thereby solidifying its third key pillar of the flywheel.

Perhaps seeking to leapfrog Amazon, Walmart recently piloted an ambitious shoppable TV project with “Add to Heart,” a holiday-themed rom-com available on TikTok, Roku, and YouTube, that features more than 300 shoppable items available at Walmart.

What’s Next for the Next-Gen RMNs?

Walmart has shown next-gen RMNs how to cultivate their own walled gardens (or perhaps “hedged gardens”), and each will need to adapt according to their comparative strengths and weaknesses. RMNs without a robust marketplace will be more reliant on off-site ads and in-store ads to reach scale. Those lacking strong loyalty programs will need to get more shoppers signed up. And they’ll all need to ink media partnerships to get access to more high-value inventory—with many already making progress.

RMNs can also now control their own destiny, much like Amazon does with its sizeable media portfolio. By acquiring digital publishers—especially at current valuations—RMNs would gain access to scaled audiences and contextually relevant content that maximize campaign effectiveness while lowering customer acquisition costs.

It’s not hard to imagine the potential pairings: grocery chains + recipe sites, pharmacies + health info sites, home improvement retailers + how-to sites, department stores + fashion sites, and sporting goods retailers + sports news sites.

Retailers may not win a Golden Globe for their digital content, but it will help them sell more shoes.