Podcasting Had Its 'Serial Moment'. Is In-Store Retail Media Ready for Its 'Cereal Moment'?

Tesco’s Digitization of the Center Aisle is a Model for US Retailers

Retail media may seem like a new trend, but CPG and retail veterans will be quick to tell you it’s been around for a long time. The Kellogg Company’s use of retail media dates back more than a century to 1906, and they’ve embraced the medium ever since.

“We are convinced that superior, in-store presence is essential to achieving consistent and reliable growth in sales and profits,” said Carlos Gutierrez, chairman & CEO of Kellogg’s at a 2002 industry conference. “In-store advertising has great strategic value and can play a key role in building brands.”

These comments of course predated the recent rise of in-store digital, but the same marketing principles apply. Advertising close to the point of sale has the best ability to stimulate or sway purchase decisions. The world’s largest CPG marketers realized it back then, and that’s as true as it’s ever been.

“I generally believe the majority of brand choice is made in a retail environment,” said P&G President & CEO Jon Moeller during a July 2023 investor call. “I think less brand choice is made sitting on a couch or even driving in a car on the way to a retail establishment. The same is true for online. So, we’re very carefully evaluating this opportunity.”

The problem is that brands are stuck in the evaluation phase. In-store retail media—the term commonly used to describe in-store digital advertising—isn’t even a $400 million market in the US. And although it’s expected to grow at a 30-50% clip over the next few years, that still puts it several years away from becoming a $1 billion market.

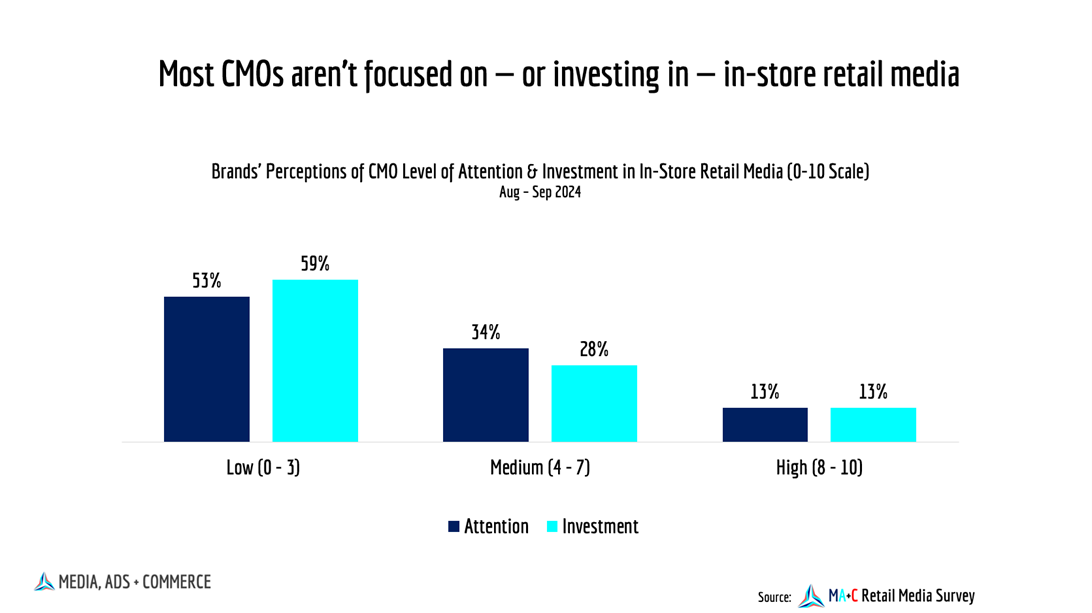

It’s no wonder the market lags its potential. According to an August-September 2024 Media, Ads + Commerce survey, the majority of CMOs give in-store retail media little attention or investment.

Brands aren’t even organized to take advantage of the opportunity. 21% say they don’t have any full-time employee with an in-store retail media job remit. Another 41% say that a full-time employee has only a partial remit for in-store retail media, but the channel is minimally prioritized.

Agencies similarly lack focus on in-store retail media, despite it representing a major future revenue driver. According to the survey, agencies give it even less attention on average (3.75 on 10-point scale) than brands (3.91) and RMNs (4.53).

“There are two key things holding media agencies back from recommending in-store media,” said John Birmingham, a media agency veteran and former CMO. “Lack of standardized approach to planning, executing and measuring, and the fact that budgets for in-store activations typically sit in a different bucket, like shopper marketing.”

Parallels Between Podcast Advertising and In-Store Retail Media

The market’s current trajectory is beginning to remind me of podcast advertising. Although terrestrial audio had been around forever, the rise of smartphones breathed new life to the medium and created more moments with which to engage audiences at a more intimate level. Anyone who listened to podcasts in the early days could tell it was an undeniably captivating medium.

Then it had its “Serial Moment” in 2014, when the serialized true crime drama—the aptly named “Serial”, an offshoot of NPR’s “This American Life”—captured the zeitgeist and brought podcasting to mainstream audiences for the first time. It set off a decade of consistently strong growth in listeners and engagement. And yet, podcast advertising is barely a $2 billion ad market today. In-store retail media looks like it’s on a similar trajectory.