Physical Retail Is the New TV

It’s Time for National Brands to Seize on the Next Major Media Investment

This article, co-authored with Keith Bryan, founder of Colosseum Strategy and former President of Best Buy Ads, originally appeared in AdWeek on March 8, 2024. The re-published article below includes additional charts and graphics that did not appear on the original article.

In-store retail media is ready for primetime. Expect 2024 to be the year that digital screens propagate across brick-and-mortar retail.

Currently estimated at less than $300 million in the U.S., in-store advertising is finally ready to accelerate, with Walmart, Kroger and Tesco announcing the expansion of their in-store media networks this year. A recent Merkle study found that in-store media is now the No. 2 area of retail media investment and a top focus of 33% of retailers—up from just 9% in 2022.

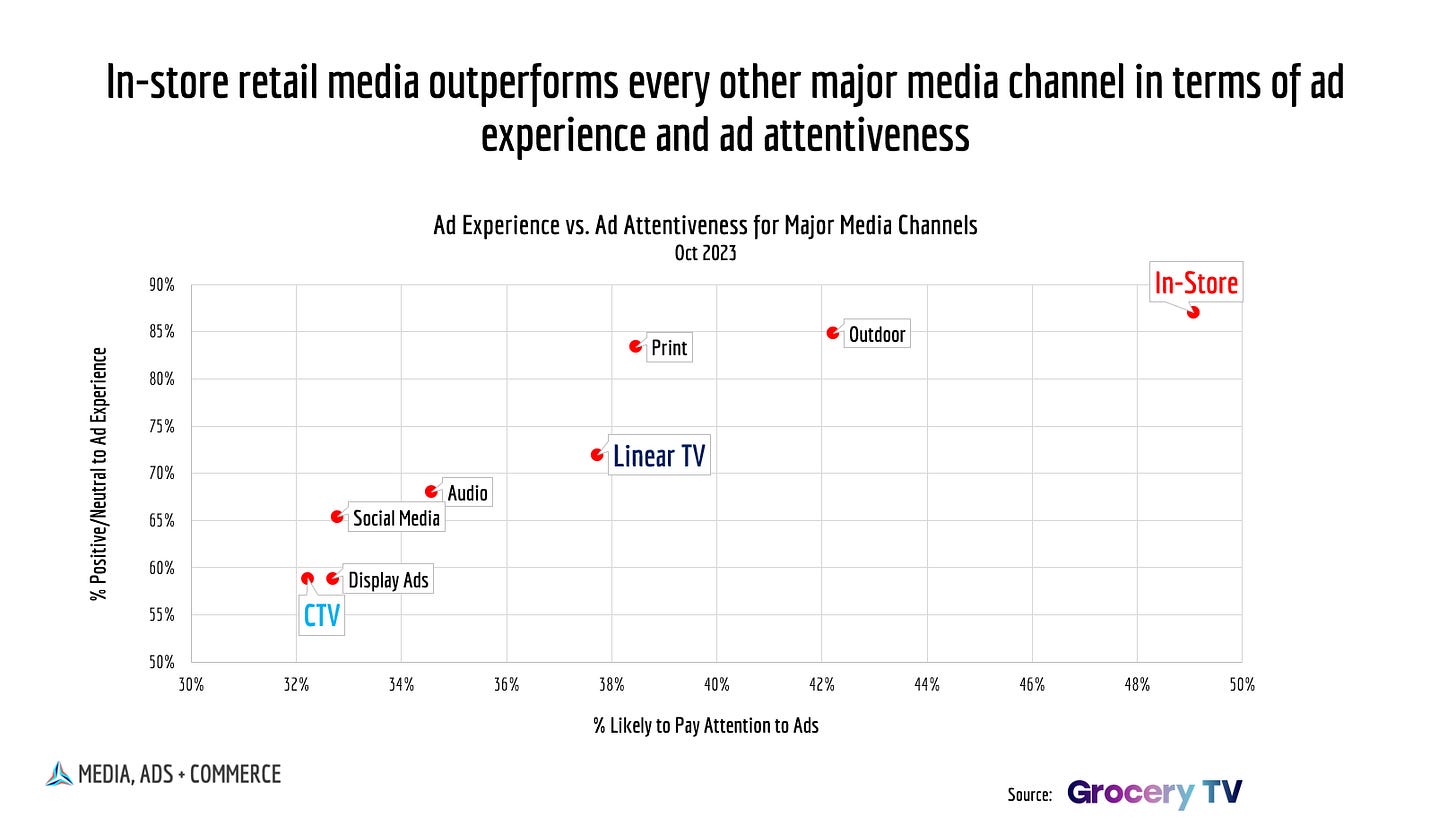

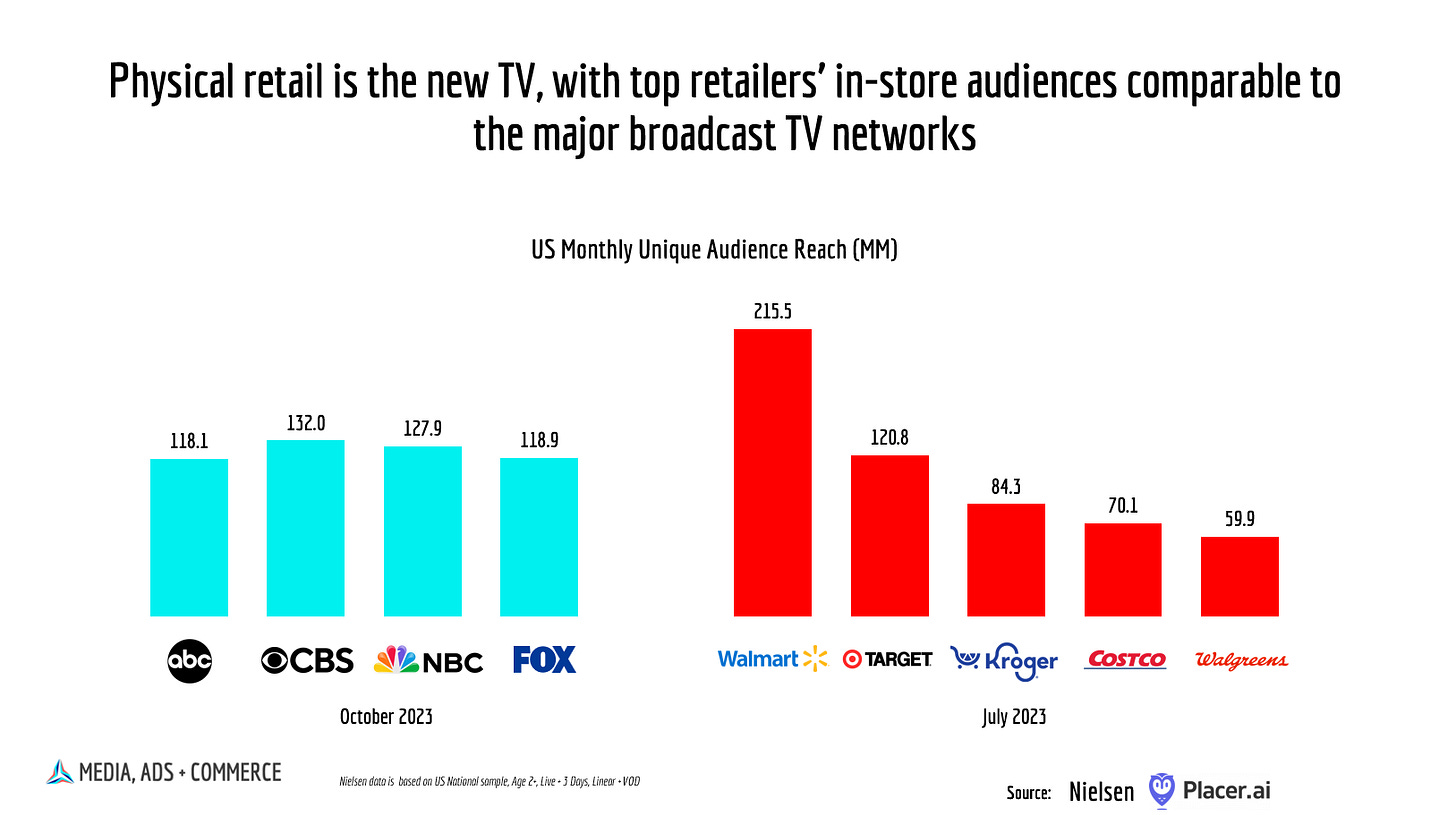

As this happens, physical stores will begin to emerge as the “new TV”—a mass-reach advertising vehicle ideal for national brands. Digital surfaces inside retailers’ four walls—whether at the front of the store, checkout, endcap, smart cart or cooler doors—deliver much of what brands want and what linear TV has lost: fast reach, high attentiveness, younger audiences and cultural relevance.

As brands continue to struggle with linear TV’s decline, they should commit to investing 5% of existing linear TV budgets in in-store media by 2025.

Physical stores will become a major media channel

The linear TV ad market is still over $65 billion—a level that’s remained static over the past decade. As supply among key demographics has roughly been cut in half, demand has stayed constant, leading to a doubling of CPMs.

That’s because these dollars haven’t had somewhere better to go. With in-store retail media, now they do.

Of course, in-store advertising isn’t a perfect substitute for linear TV advertising—the context isn’t conducive to extended storytelling and the full range of sight, sound and motion. Still, it delivers many of linear TV’s primary benefits, including dayparting and geoparting. And what it may sacrifice in 30-second storytelling, it makes up for with greater format flexibility, contextual narrative and cultural cachet.

One of in-store retail media’s earliest incarnations—the Best Buy “TV Wall”—was introduced in 2011 as a way for national brands to reach shoppers in a high-visibility, high-attention and high-intent environment. Often serving as extensions of national brands’ TV ad campaigns, TV wall ad buys lean into mid- and upper-funnel marketing objectives like awareness and aren’t just about driving a purchase on that shopping visit.

In this era of media fragmentation, the number of true common cultural touchstones is dwindling. Outside of major tentpole events like the Super Bowl, the Olympics and the Oscars, physical stores are among the last remaining bastions that can quickly deliver tens of millions of eyeballs.

The top U.S. retailers have a unique audience reach of 100 million per month, on par with the top broadcast TV networks.

They also reach the “unreachables,” the coveted “money demo” that now barely watches linear TV.

And unlike social or programmatic, retail ad inventory offers scarcity and brand safety in a premium environment. These branding benefits come with the bonus of contextual relevance and proximity to the point of purchase.

The smartest brands already get this. Go into virtually any retail store with digital screens and you’re likely to see Apple ads. It’s not just at retailers where Apple products are sold, but also in grocery stores and drug stores nationwide.

National brand budgets—not shopper marketing—should fund in-store ads

Stunningly, many brands still fail to see the big picture, relegating in-store media to shopper marketing—or comparatively tiny digital out-of-home—budgets. This massive channel isn’t even on the radar of most national brand teams, nor do they have strategists with an in-store media remit. Organizational dynamics are getting in the way of what should matter most to brands: marketing effectiveness.

Emerging media channels are often held back by the lack of inventory scale and measurement to justify large investments from national brands. This has certainly been true of connected TV, which wasn’t counted in Nielsen TV ratings and has had minimal ad-supported inventory until recently. Now measurement is catching up right as Netflix, Prime Video and Apple TV+ embrace ad-supported models.

In-store retail media isn’t lacking in reach, and recent advances are delivering scalable sales lift measurement and in-store audience metrics. We are one step closer to the in-store equivalent of Nielsen TV ratings, which would facilitate the movement of national media investment. Additionally, the tech is adopting some of the advancements of digital, such as programmatic targeting and closed-loop measurement, and has the potential to generate new customer and brand opportunities that integrate natively with shoppers’ smartphones, opening richer app, loyalty and promotional experiences akin to shoppable ads on CTV. So, the eventual impact could be far greater than just content and ads on screens in stores.

National brands need to break their overreliance on linear TV eventually, so why not now? By committing budget to this channel as screens roll out in stores nationwide this year, they can aggressively test and learn to understand how in-store advertising works. And it can be done even as programmatic and measurement capabilities mature. In-store retail media can be planned through scaled direct ad buys, much in the way that linear TV is today.

As physical stores get ready for primetime, brands should start preparing for The StoreFronts.

The future is exciting! I haven't been able to find best practices or tips on how to create great retail media ads (f.e. on in store TV's). For all other advertising channels these best practices and guidances are everywhere. For retail media I haven't found yet good examples online.