2025 Will Be the Year of Full-Funnel Retail Media

New Markets Will Emerge as Retailers Come out of Denial as Media Companies

“Retailers are media companies in denial,” said Keith Bryan, my partner at Colosseum Strategy and former President of Best Buy Ads. “2025 will be the year that many come out of denial.”

What does it mean exactly for retailers to come out of denial?

“Most retail media networks are relatively sequestered from retailers’ core strategic, operational, and economic organizational structures. That’s still a symptom of denial,” he said.

“In 2025, retailers will begin to seriously address internal and external pressure to integrate their RMNs with established, mature parts of their organization such as merchandising, media, customer experience, omni-channel commerce including marketplaces, and financial management such as margin attribution and incentives.”

Integration is inevitable for coming out of denial and is the only way for retailers to create a viable, sustainable model that serves customers, brands, and shareholders.”

It also requires developing a culture of media excellence, built around elevating CX and improving the customer journey through high-quality content, creative, and advertising experiences.

As retailers come out of denial and embrace their inner media companies, new markets—across all phases of the marketing funnel—will emerge.

UPPER-FUNNEL

Retail Media-Powered CTV Will Bring Performance Advertising to TV

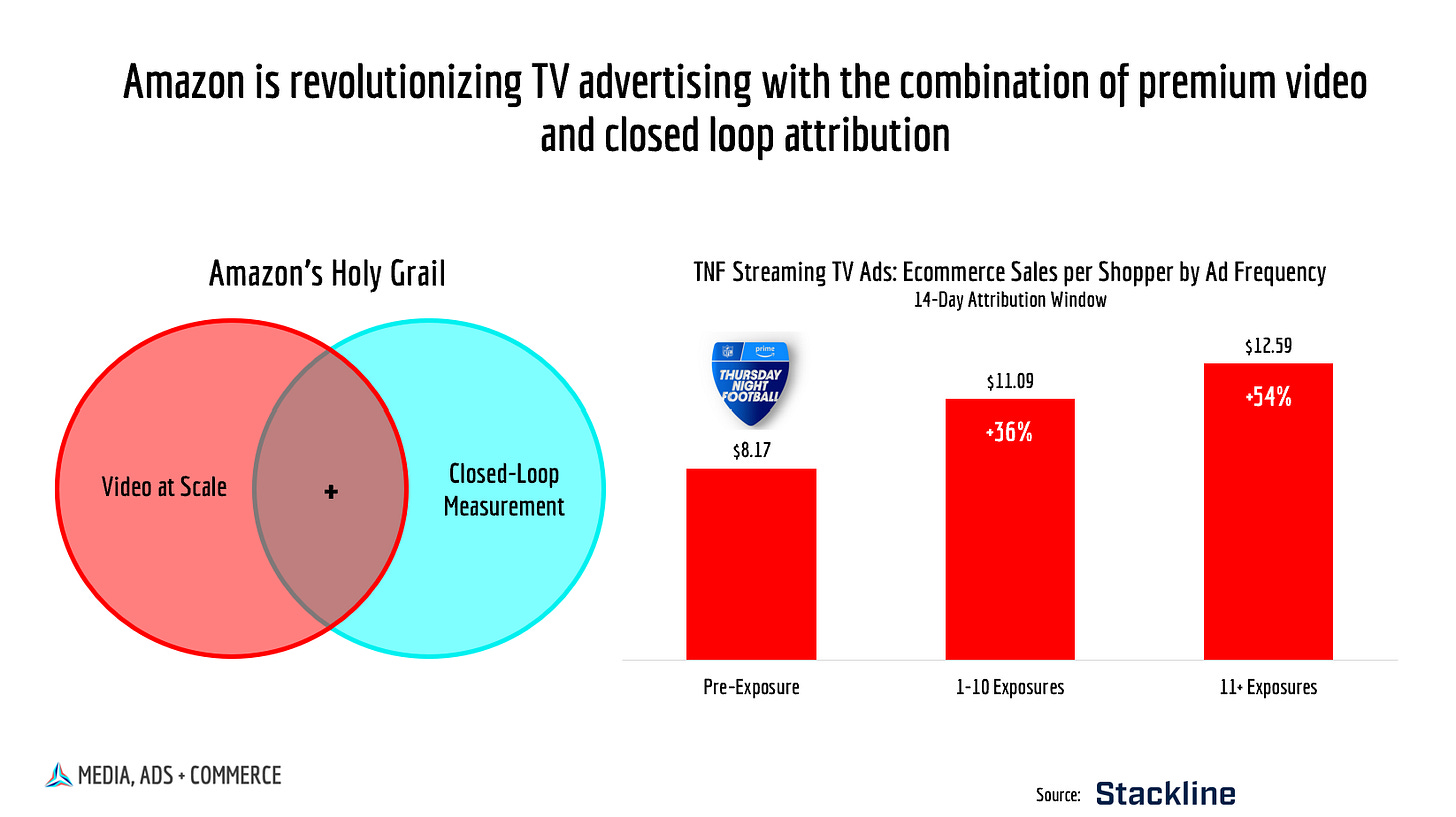

Retail media is ready to take the classic upper-funnel medium into the lower-funnel. Linear TV—a reach medium used primarily for branding—has always been seen as an effective advertising channel. But it has also been among the least measurable of all media. Until now.

“CTV is a great example of integrating retail and media,” added Bryan. “Historically, you had to choose between mutually-exclusive brand-building with TV investments or performance-oriented media like search. When retail media powers CTV with audiences, shoppability, and measurement, you don’t have to choose—you get both branding and performance.”

2025 will be a year of disruption in the TV market as RMNs bring closed-loop targeting and attribution to premium video at scale. The groundwork laid by Amazon and Walmart in 2024 will set the foundation for change in the year ahead.

Amazon began 2024 by defaulting Prime members to the ad-supported tier of Prime Video, with viewers having to pay an additional $2.99 per month for the ad-free tier. In the fall, Amazon introduced shoppable TV ad units to NFL Thursday Night Football telecasts, building upon its closed-loop attribution capabilities first introduced during the 2023 season.